Adjustable Rate Mortgage is fixed for the first seven years. This product has a 30-year amortization and requires 84 monthly payments of $3,537, followed by 276 monthly payments of $3,449. With an ARM loan, the rate is variable and may increase or decrease every 6 months after the initial fixed rate period based on changes to the index. The monthly payments shown do not incldue amounts for taxes and insurance premiums, so the actual payment obligation may be greater.

Rates shown assume standard mortgage qualifications, underwriting requirements, and Automatic Payment discount. For adjustable-rate mortgages, the discount is applicable only during the initial fixed-rate period. All terms and conditions applicable to the checking or savings account apply, including fees and minimum opening deposits. Example based on refinance of owner-occupied, one unit, single family residence in Los Angeles, California with a loan amount of $800,000, 80% loan-to-value, and minimum 740 FICO score.

These rates are intended for informational purposes and are not an offer to extend consumer credit. The 30-Year Fixed Mortgage provides for fixed, fully amortizing principal and interest payments for the life of the loan. The monthly payments shown do not include amounts for taxes and insurance premiums, so the actual payment obligation may be greater.

Example based on refinance of owner-occupied, one unit, single family residence in Los Angeles, California with a loan amount of $250,000, 80% loan-to-value, and minimum 740 FICO score. The 15-Year Fixed Mortgage provides for fixed, fully amortizing principal and interest payments for the life of the loan. If you already have an adjustable rate mortgage or "ARM", your interest rate may be lower in the short-term but could increase after the initial fixed rate period ends and the rate resets.

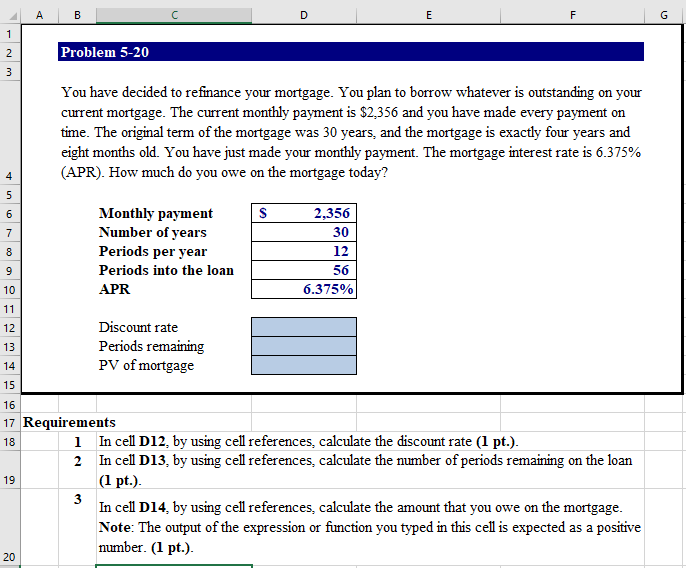

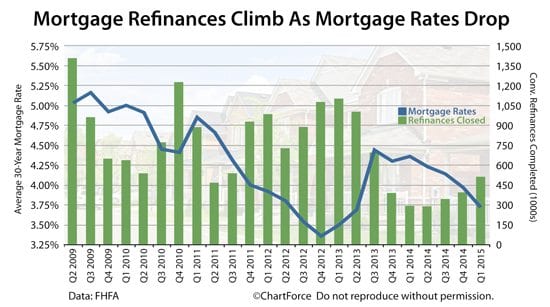

When fixed mortgage interest rates are low, refinancing to a fixed rate mortgage could be a great opportunity to save money and lock in the rate for the life of the loan. The change in your monthly payment will not vary and you will not have to worry about rising interest rates in the future. Often adjustable rate hybrid mortgage loan products will be lower than your fixed rate mortgage. Products called 5/1, 7/1 and 10/1 ARMs have a fixed rate for that initial term , then become a variable rate for the remaining years. During those remaining years, your rate can remain the same, increase, or decrease depending on market conditions at that time.

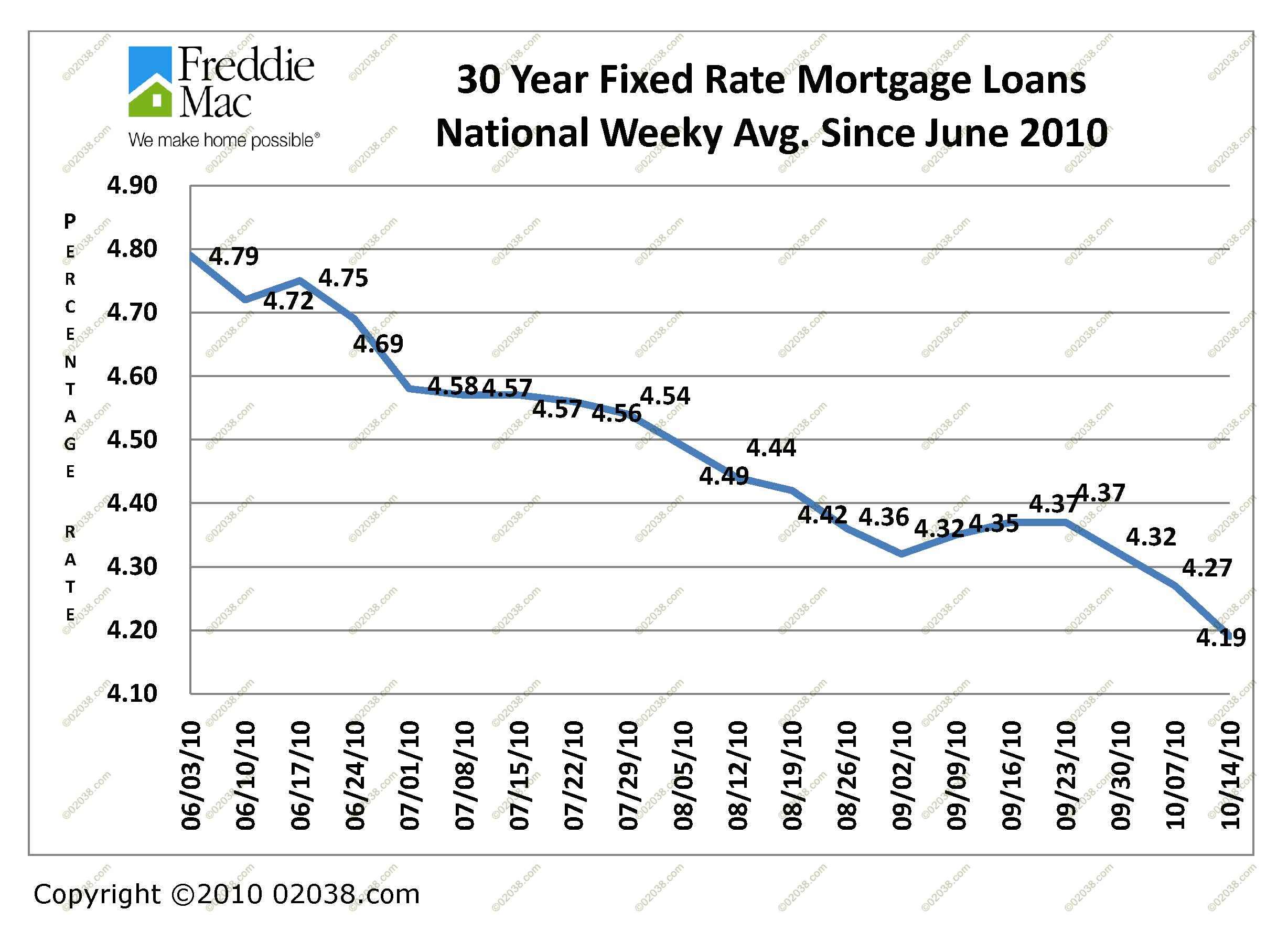

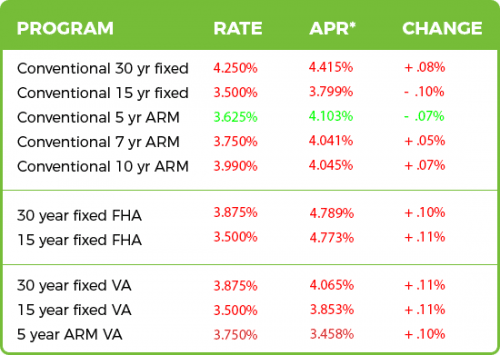

The potential rate change after the initial fixed period should be considered when considering this option. The monthly savings you create could be used to paydown your principal faster. You should consider refinancing your home loan if your current mortgage rate exceeds today's mortgage rates by more than one percentage point. Mortgage refinance fees and closing costs would cut into your savings. You also have to consider whether your credit score would qualify you for today's best refinance rates. Chart data is for illustrative purposes only and is subject to change without notice.

Advertised rate, points and APR are based on a set of loan assumptions . Chart accuracy is not guaranteed and products may not be available for your situation. Monthly payments shown include principal and interest only, and , any required mortgage insurance. Any other fees such as property tax and homeowners insurance are not included and will result in a higher actual monthly payment. Advertised loans assume escrow accounts unless you request otherwise and the loan program and applicable law allows. Should you choose to waive escrows, your rate, costs and/or APR may increase.

Select the About ARM rates link for important information, including estimated payments and rate adjustments. If you have an adjustable rate mortgage and are concerned that your interest rate and monthly payment might increase, refinancing to a fixed rate mortgage can provide a stable monthly payment. People who plan to stay in their homes for 7 years or longer tend to prefer fixed rate mortgages. Alternatively, if you know you will only be in your home for a short time, refinancing to an ARM could provide monthly savings and additional cash flow. It's best to talk with your loan office to determine the right approach for your situation.

Bankrate's mortgage calculator can help you estimate your monthly mortgage payment based on a variety of factors that you choose. You can also factor in your credit score range, ZIP code and HOA fees to give you a more precise payment estimate. This information is being provided for informational purposes only and is neither a loan commitment nor a guarantee of any interest rate. If you choose to apply for a mortgage loan, you will need to complete our standard application. Our loan programs are subject to change or discontinuation at any time without notice.

Refinancing to reduce total monthly payments may lengthen repayment term or increase total interest expense. When rates dip or your personal finances change, it could be a good time to refinance your mortgage. Depending on your situation, you might use a new mortgage to get cash out or to gain a lower interest rate with lower monthly payments or a shorter term.

Your KeyBank mortgage loan officer will talk you through all of your options, so you'll always know exactly what to expect. Make mortgage payments more predictableIf you have an adjustable rate mortgage, you can refinance your home loan to a fixed rate mortgage and make your monthly payments more predictable. With an adjustable rate mortgage, your interest rate and monthly payments can change every year. With a fixed rate mortgage, your interest rate and monthly payments stay the same. The mortgage refinance rate we may be able to offer is personal to you. Your interest rate is affected by the type of refinance loan you want, your credit score, your income and finances, as well as the current mortgage market environment.

Freedom Mortgage may be able to offer you a refinance rate that is lower - or higher - than the rate you see advertised by other lenders. Freedom Mortgage may be able to offer you a refinance rate that is lower – or higher – than the rate you see advertised by other lenders. Your actual rate may be higher or lower than those shown based on information relating to these factors as determined after you apply. Conforming ARM Loans - Conforming rates are for loan amounts not exceeding $548,250 ($822,375 in Alaska and Hawaii). Adjustable-rate mortgage loans and rates are subject to change during the loan term.

That change can increase or decrease your monthly payment. Annual Percentage Rate calculation is based on estimates included in the table above with borrower-paid finance charges of 0.862% of the base loan amount, plus origination fees if applicable. If the borrower-equity is less than 20%, mortgage insurance may be required, which could increase the monthly payment and the APR. Bankrate's rate tables are updated every business day and contain up-to-date interest rates, APRs, upfront fees and monthly payments for the amount you choose.

Utilize these tables to familiarize yourself with the mortgage rates that are currently available, then compare them to decide which option best suits your financial needs. Keep in mind that these are average rates for comparison shopping. Your exact rate will depend on multiple factors, including your credit score, the size of your loan, the location of your house and the term of your mortgage. When finding current mortgage rates, the first step is to decide what type of mortgage best suits your goals and budget.

Most borrowers opt for 30-year mortgages, but that's not the only choice. Typically, 15-year mortgages have lower rates but larger monthly payments than the more popular 30-year mortgage. Adjustable-rate mortgages usually have lower rates to begin with, but the downside is that you're not locked into that rate, so it can change over the life of your loan. Refinancing a mortgage can often help borrowers save big-time by scoring a lower rate or lowering their monthly payments. If you're considering refinancing, it's best to crunch the numbers first.

Our mortgage refinance calculator can help you determine whether refinancing is worth it. Enter the details of your existing mortgage and new mortgage to determine your new monthly payment. If you obtained your current fixed-rate mortgage when interest rates were high, you may be able to save a significant amount in both your monthly payments and over the life of the loan. You may be surprised to learn just how much even a relatively small decrease in your interest rate can save you thousands of dollars over the life of the loan. For example, if you are thinking about a mortgage refinance which will save you $100 a month and has $1,500 in closing costs, it will take you 15 months to "break even" and begin to save money.

This is the reason real estate professionals often recommend you do not refinance your mortgage when you are planning to sell your house soon. That's because the savings from a refinance might be minimal if you only live in the house a short time before you sell. You can use our mortgage refinance calculator to help you estimate your potential savings. Nearly all types of refinance loans fall under the "rate and term" category, which is simply when either the rate or repayment term on your mortgage is changed. Typically, you're replacing your existing loan with one that has a more favorable interest rate or terms. A longer loan term will have smaller monthly payments, but you'll pay more interest over the life of the loan.

A shorter term loan will have a lower interest rate, but a higher monthly payment. Refinancing your mortgage can help you in a number of ways. You also might want to refinance to cash out some of your home equity and pay for home renovations or other expenses.

To determine whether it makes sense for you to pay discount points, you should compare the cost of the discount points to the monthly payments savings created by the lower interest rate. Divide the total cost of the discount points by the savings in each monthly payment. This calculation provides the number of payments you'll make before you actually begin to save money by paying discount points. A Cash-Out Refinance is a mortgage refinance that allows you to access equity in your home. And instead of adding another monthly payment to your list, you'll only have to make one — your regular mortgage payment. Another type of refinance is a "cash-in" refinance, where you can pay down your loan as part of the refinance to get a smaller monthly payment.

Increasing your equity, or decreasing your principal balance relative to the value of your house, could also help you drop private mortgage insurance payments. The length of your loan's repayment term will also impact your refinance rate. Shorter term loans have lower rates than longer repayment terms, all else being equal. Ideally, your new refinance loan won't be adding years onto your mortgage, but you can also pay off your mortgage more quickly with a shorter loan term. The downside is that shorter repayment terms will increase your monthly payment, so you'll need to be able to fit a bigger mortgage payment into your budget. See our current mortgage rates, low down payment options, and jumbo mortgage loans.

While low average mortgage and refinance rates are a promising sign for a more affordable loan, remember that they're never a guarantee of the rate a lender will offer you. Mortgage rates vary by borrower, based on factors like your credit, loan type, and down payment. To get the best rate for you, you'll want to gather rates from multiple lenders.

Use our mortgage refinance calculator to estimate how much you might save by lowering your interest rate, changing your loan term, and more. By refinancing, the total finance charges you pay may be higher over the life of the loan. A refinanced mortgage gives a homeowner a new mortgage loan to replace the existing one. The amount, rate and term of the new loan can be tailored to the homeowner's needs.

You can refinance to have a lower monthly mortgage payment, take out cash for home improvements or other expenses, and more. For 30-year fixed refinances, the average rate is currently at 2.99%, a decrease of 1 basis point over this time last week. (A basis point is equivalent to 0.01%.) One reason to refinance to a 30-year fixed loan from a shorter loan term is to lower your monthly payment.

If you're having difficulties making your monthly payments currently, a 30-year refinance could be a good option for you. However, interest rates for a 30-year refinance will typically be higher than rates for a 15-year or 10-year refinance. Check out the mortgage rates charts below to find 30-year and 15-year mortgage rates for each of the different mortgage loans U.S.

If you decide to purchase mortgage discount points at closing, your interest rate may be lower than the rates shown here. To learn more about rates and to see what you may qualify for, contact a mortgage loan officer. With these loans, you don't have to pay the closing costs upfront, but you could see a higher monthly payment. Lenders cover the cost of the refinancing by charging a higher interest rate or rolling the fees into the total loan amount. While mortgage rates have risen from the record lows of late 2020 and early 2021, they remain at historically low levels.

That means millions of homeowners still could save by refinancing. It's also possible to tap into your home equity to pay for home renovations. Or, if you want to pay down your mortgage more quickly, you can shorten your term to 20, 15 or even 10 years. And because home values have risen sharply, it's possible that a refinance could free you from paying for private mortgage insurance. Switching to an adjustable rate mortgage may be ideal if you don't plan to own the home for a long period or you're expecting an increase in income.

With an ARM, you could start with a lower interest rate and lower monthly payments for the first few years. Your rate is set for a predetermined period, then will reset once every six months with a new rate that can be either higher or lower depending on market conditions at the time. As you can see, slight differences in mortgage rates have an impact on your monthly payment. At the low average mortgage rate of 3.15%, your monthly mortgage payment would be $859. An adjustable rate mortgage is a loan with an interest rate that fluctuates based on a publically-available interest rate index .

Many adjustable rate mortgage loans have a fixed interest rate period, typically 3, 5, 7, or 10 years. After the fixed rate period has ended, your interest rate can go up or down depending on the interest rate index in effect at that time. If you put down less than 20% of the purchase price when you first purchased your home, or have an FHA loan, you most likely have mortgage insurance as part of your monthly payment. Depending on the equity now in the property, mortgage insurance can be removed and save you money every month.

Check with a loan officer to see if you're eligible to remove your mortgage insurance payment. With interest rates as low as they are right now, this is the perfect time to refinance your existing mortgage to a lower rate. Lowering your interest rate will generally reduce your monthly payment.

This monthly savings can be used to build your savings account, put towards other financial needs, or can be used to paydown your mortgage principal balance. We receive current mortgage rates each day from a network of mortgage lenders that offer home purchase and refinance loans. Mortgage rates shown here are based on sample borrower profiles that vary by loan type. Make sure to consider your goals and financial situation, including how long you plan to stay in your current home.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.